Socolive – Trực tiếp bóng đá chất lượng cao miễn phí 2024

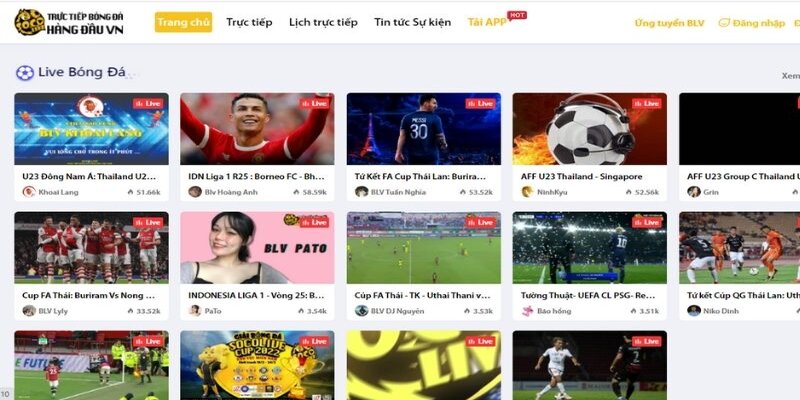

Socolive – Trực tiếp bóng đá Socolive chất lượng cao hoàn toàn miễn phí cho anh em. Xem bóng đá sôi động cùng đội ngũ bình luận viên chuyên nghiệp cùng đội ngũ SÓC hỗ trợ tận tâm, tận tình và chu đáo cho anh em

Giới thiệu về trang web uy tín Socolive

Được biết đến là một trong những địa chỉ cung cấp các sản phẩm cá cược thể thao đẳng cấp và thu hút được lượng lớn bet thủ tham gia. Đây được xem là sân chơi uy tín, công bằng minh bạch nhất nhì trên thị trường cá cược bóng đá số.

Kể từ khi mới ra mắt trên thị trường, các sản phẩm thể thao tại trang web đã thu hút được lượng lớn bet thủ tham gia cá cược. Bởi vì, website mang đến cho người chơi rất nhiều ưu điểm nổi bật. Không những vậy, trang web còn cung cấp đa dạng các kèo cược bóng đá với các trận đấu trong nước và quốc tế khác nhau.

Người chơi hoàn toàn có thể yên tâm khi tham gia các kèo cược bóng đá tại Socolive vì đã được các cơ quan quốc tế cấp giấy phép hoạt động cá cược hợp pháp. Khi tham gia trải nghiệm các dịch vụ cá cược tại đây, người chơi không cần lo lắng về vấn đề bảo mật thông tin. Tất cả các thông tin khách hàng sẽ được mã hóa bằng công nghệ hiện đại nhất và lưu trữ tại trung tâm an ninh mạng.

Mục tiêu hàng đầu của trang web bóng đá Socolive đó là mang đến cho khách hàng sự hài lòng. Chính vì vậy, luôn đảm bảo sự chuyên nghiệp, minh bạch và luôn đặt quyền lợi khách hàng lên trên hàng đầu. Đây cũng chính là phương châm hoạt động của website mang đến cho anh em những trải nghiệm tuyệt vời nhất trong suốt mọi thời đại.

Trang web bóng đá Socolive mang đến cho bạn điều gì?

Nếu anh em đang muốn tham gia cá cược bóng đá trực tuyến và đang tìm kiếm một sân chơi uy tín, đáng tin cậy. Nhất định người chơi đừng nên bỏ qua trang web Socolive – chuyên trang bóng đá được đánh giá cao. Sau đây là một số lý do thành viên nên tham gia cá cược tại đây:

Thông tin cá nhân của thành viên được bảo mật an toàn 100%

Là chuyên trang cung cấp dịch vụ bóng đá có uy tín trên thị trường cá cược. Với đội ngũ nhân viên chuyên nghiệp mang đến cho thành viên đa dạng các sản phẩm – dịch vụ cá cược. Trang web đang dần chiếm được sự tin tưởng của rất nhiều người chơi trên toàn thế giới.

Xét về độ an toàn và bảo mật trang web luôn được ưu tiên lên hàng đầu. Tất cả các thông tin cá nhân và giao dịch đều được bảo mật nghiêm ngặt và chặt chẽ. Sẽ đảm bảo dữ liệu cá nhân của thành viên không bị rò rỉ thông tin hay lừa đảo người chơi.

Xem bóng đá trực tuyến Full HD hoàn toàn free

Socolive không chỉ đáp ứng nhu cầu người dùng còn tận dụng công nghệ hiện đại để cung cấp dịch vụ xem bóng đá trực tuyến với chất lượng Full HD và hoàn toàn free. Với chất lượng video cao và cung cấp trải nghiệm trọn vẹn cho người tham gia. Website cho phép người xem tận hưởng mỗi trận đấu với độ phân giải cao, hình ảnh sắc nét và tạo nên một không gian giải trí chất lượng.

Dịch vụ CSKH chu đáo đáng tin cậy 24/7

Đến với trang web Socolive khách hàng không cần lo lắng vì đã có nhân viên luôn sẵn sàng hỗ trợ 24/7 và sẽ giải đáp mọi thắc mắc của người chơi. Thành viên sẽ được hỗ trợ nhanh chóng và tận tình bởi đội ngũ nhân viên. Chuyên viên tại đây được đào tạo rất bài bản và chuyên nghiệp. Chắc chắn với những kinh nghiệm có được sẽ giải đáp chi tiết được mọi yêu cầu của khách hàng.

Socolive cập nhật kết quả và lịch thi đấu bóng đá nhanh nhất

Đến đây thành viên sẽ được cập nhật đầy đủ và chính xác kết quả bóng đá một cách nhanh nhất và kịp thời. Kết quả được hiển thị rõ ràng, chi tiết đặc biệt còn có các video ghi lại các pha bóng đột phá và gay cấn nhất. Ngoài ra, trang web cũng cập nhật liên tục lịch thi đấu bóng đá của các giải đấu lớn nhỏ trên toàn quốc để người chơi có thể dễ dàng nắm bắt.

Website cung cấp link xem bóng đá online siêu chất lượng

Socolive – trang web trực tuyến bóng đá đáng tin cậy. Cung cấp và cập nhật các link xem bóng đá chính thức, với chất lượng full HD. Người chơi sẽ được trải nghiệm các giải đấu bóng đá lớn nhỏ trên toàn cầu một cách hài lòng. Xem một cách mượt mà và không bị lag, giật hay là gián đoạn… Đặc biệt, còn có bình luận tiếng Việt siêu dễ hiểu, các BLV thân thiện và cực kỳ hài hước. Người chơi tham gia còn được trao đổi trực tiếp ý kiến với các chuyên gia, bình luận viên.

Hướng dẫn tân binh cách tham gia cá cược bóng đá trên Socolive

Để tham gia cá cược bóng đá người chơi cần tạo tài khoản tại trang web. Hãy thực hiện đúng theo những hướng dẫn mà chúng tôi chia sẻ dưới đây:

Bước 1: Người chơi đăng nhập vào tài khoản Socolive thông qua truy cập đường link chính thức của website.

Bước 2: Tại giao diện cược của trang web, anh em bấm chọn “Thể thao” sau đó hãy nhấp chọn sảnh cược mà mình muốn tham gia.

Bước 3: Người chơi hãy nạp một số tiền vừa đủ để tham gia những màn cược kèo đẳng cấp. Hãy lên kế hoạch và tính toán để nạp số tiền phù hợp.

Bước 4: Sau khi đã xác nhận nạp tiền nhận điểm chơi, thành viên sẽ được chuyển sang sảnh thể thao. Lúc này, anh em hãy quan sát bên trái màn hình và chọn vào biểu tượng quả bóng để xem được bảng kèo mà trang web cung cấp. Tại đây, website sẽ cung cấp đến người chơi toàn bộ thông tin cá cược của tất cả trận đấu diễn ra trong thời gian thực.

Bước 5: Nếu yêu thích kèo đấu nào, thành viên hãy ấn vào ô tỷ số để cược. Lưu ý hãy nhớ quan sát tỷ lệ kèo để chọn sao cho chuẩn xác.. Sau đó, chỉ cần nhập vào điểm cược mà mình muốn rồi ấn “ Xác nhận” để hoàn tất.

Kinh nghiệm tham gia cá cược bóng đá tại Socolive

Tham gia cá cược hay soi kèo bóng đá một hoạt động giải trí được nhiều người yêu thích. Tuy nhiên, để giành được chiến thắng thì đây lại là điều không phải dễ dàng. Sau đây là những kinh nghiệm có thể giúp bạn đưa ra được nhận định bóng đá hiệu quả chắc thắng.

Đặt cược bóng đá theo chu kỳ

Phương pháp này sẽ giúp người chơi gia tăng được chiến thắng khi đặt cược. Đây là một trong những kinh nghiệm cá cược bóng đá số tại website Socolive giúp bạn nhận ra được đội bóng nào đang có phong độ ổn định nhất mùa giải.

Phương pháp đặt cược này dựa trên sự quan sát và kinh nghiệm từ những giải đấu của bạn. Anh em hãy cố gắng theo dõi các trận đấu, sau đó hãy thống kê để tìm ra quy luật đội bóng nào sẽ giành chiến thắng trong trận tiếp theo.

Theo các chuyên gia chia sẻ anh em nên tìm hiểu những đội bóng mà mình yêu thích. Sau đó, hãy quan sát thật kỹ đội bóng đó để tìm ra quy luật cá cược. Cuối cùng, hãy đặt cược vào khoảng thời gian đội bóng đó đang có phong độ chu kỳ ổn nhất.

Chiến lược đánh kèo dưới có chọn lọc

Nếu là tân binh mới gia nhập vào kèo cá cược bóng đá thì chọn kèo dưới sẽ giúp tăng khả năng chiến thắng của bạn lên. Sau đây, Socolive chia sẻ chiến lược đánh kèo dưới có chọn lọc cho những anh em đam mê, cùng xem nhé:

- Hai đội bóng có lực lượng, phong độ, chiều cao ngang ngửa nhau.

- Đội bóng đang ở kèo trên khoảng thời gian này bị sa sút và liên tục tụt dốc trên bảng xếp hạng.

- Khi mà đội bóng kèo trên mới nhận được chiến thắng vang dội.

- Anh em chọn kèo dưới hãy nên phân tích thật kỹ các thông tin để đưa ra được cửa cược chính xác.

- Hãy phân tích cẩn thận thông tin hai đội bóng mà bạn muốn soi kèo.

Hãy cố gắng giữ vững tâm lý

Anh em hãy cố gắng giữ vững tâm lý khi chơi nhằm đưa ra quyết định đúng đắn. Anh em hãy cố gắng kiểm soát được cảm xúc của mình và chọn đúng thời điểm thêm cược để bảo toàn được nguồn vốn của mình. Bởi vì nếu không kiểm soát được tâm lý của mình rất dễ dẫn đến thua cược và mất trắng.

Khi tham gia tại trang web Socolive anh em dù thắng hay thua cung lưu ý giữ vững được tâm lý. Điều này sẽ giúp anh em đưa ra được chiến thuật đúng đắn. Đây cũng chính là kinh nghiệm tham gia cá cược bóng đá mà anh em nên khắc cốt ghi tâm.

Hãy đặt ra giới hạn thắng – thua, tiền cược

Anh em nên hiểu khi soi kèo bóng đá thì thắng thua cực kỳ quan trọng. Bởi vì, nếu thua 1 trận lớn bạn sẽ ăn được một khoản tiền siêu lớn. Hơn nữa, thắng nhỏ liên tục nhiều trận cũng sẽ giúp bạn thu được một số tiền cược khổng lồ.

Socolive khuyên bạn nên biết cách đặt cho mình một giới hạn tiền cược nhất định. Cho dù bản thân thắng thua ít hay nhiều thì tuyệt đối không được vượt qua hạn mức mà mình đã đặt cược. Như vậy sẽ giúp anh em tránh được tình trạng ngủ quên trong chiến thắng.

Tìm kiếm một trang web bóng đá an toàn để gia nhập

Ngoài những kiến thức chuyên môn về nhận định bóng đá anh em cũng nên chú ý đến việc lựa chọn một trang web uy tín. Trên thị trường cá cược hiện nay có rất nhiều website đáng tin cậy nhưng cũng có không ít trang web gian lận, lừa đảo.

Nếu bạn vẫn chưa tìm được trang web ưng ý, thì có thể tìm đến website Socolive – một trong những địa chỉ xuất sắc và được nhiều người đánh giá cao. Đây là trang cá cược bóng đá trực tuyến hàng đầu chắc chắn sẽ đem đến cho người chơi sự hài lòng.

Lời kết

Như vậy, Socolive – trang web cá cược bóng đá trực tuyến mang đến cho người chơi rất nhiều dịch vụ hấp dẫn. Đến đây ngoài chất lượng sản phẩm tốt thì các dịch vụ trang web cung cấp đều free 100%. Vậy, người chơi còn chần chờ gì nữa mà không nhanh tay đăng ký tham gia cá cược bóng đá trực tuyến tại địa chỉ uy tín Socolive ngay hôm nay.